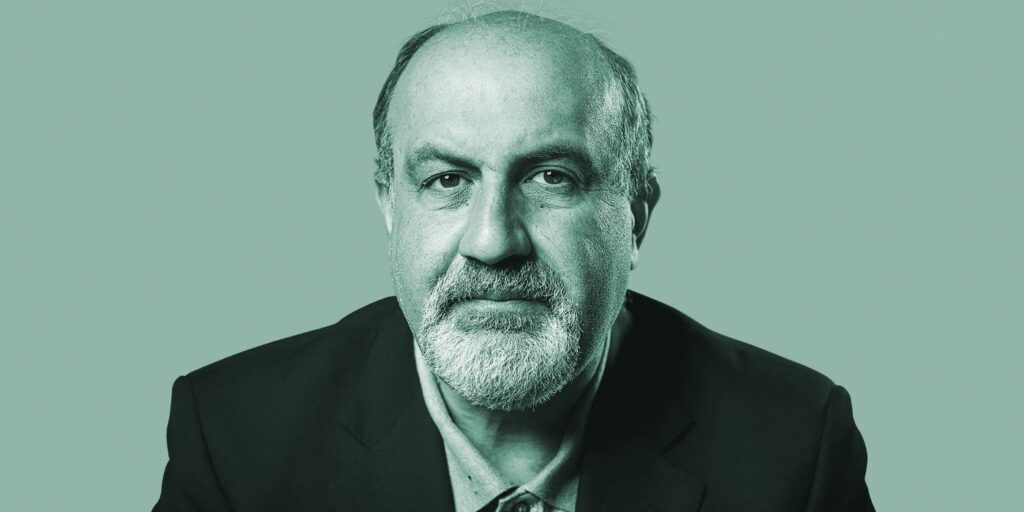

I’d like to begin with homage to a thinker whose writing frustrated me, enlightened me, and then frustrated me again: Nassim Nicholas Taleb. Nassim Nicholas Taleb is a student of randomness. In “Black Swan: The Impact of the Highly Improbable”, he is abstruse, indirect, and expresses his ideas in a roundabout way. I cannot claim to understand all or even most of his ideas, but a few I find incredibly incisive and thought provoking — one of which is what he calls the Ludic Fallacy.

What Taleb was inspired to call the Ludic Fallacy comes from the Latin ludus, a noun which means “game”. The Ludic Fallacy is when people mistake the role of randomness in their lives; in essence, these people assume that randomness occurs in their lives within well-laid out rules, when in reality, most of us experience randomness in our daily lives in the most haphazard way. Perhaps, the best way to understand how the Ludic fallacy affects us is using a fictional story Taleb himself uses. In his book, Taleb describes a probabilistic thought experiment, because thought experiments are cheap, and do not generally require IRB approval. Also, to those of you getting bad memories of college statistics classes, requesting you to “please calculate the odds of 4 aces (or any other annoyingly impossible sequence of cards) being pulled out of a randomly shuffled deck one after the other”, you can rest in peace. This is not one of those thought experiments.

Respectable, orderly, and academically decorated, Dr. John has completed a doctorate in statistics, a post-doctorate in a a subfield of statistics, and now works as an industry researcher studying a subfield of the subfield he got his post-doc in.

Meanwhile, Fat Tony is the antithesis of Dr. John. Fat Tony is a street smart, fast-talking, Brooklyn real-estate agent. Everything he has learnt in life, he has learnt from the street. He lacks advanced Ivy League degrees and academic honors, yet has managed to make a comfortable living for himself — might we add, a living slightly more ‘comfortable’ than Dr. John. One day Fat Tony and Dr. John end up in a bar together sipping beer on neighboring bar stools, against all odds (bars have this odd property of bringing complete strangers together in the same place). Enter Nassim Nicholas Taleb, the consummate student of randomness. As such professors typically do, Taleb poses a question to both Fat Tony and Dr. John

— –

Taleb: “I am going to flip this fair coin 100 times, and after the 99th toss, I want each of you to tell me the probability of the 100th being heads. You should know that each toss is independent and the that the coin is fair.”

Taleb flips the coin 99 times and each of the 99 tosses results in a heads.

Taleb: “Now before, I toss the coin for the 100th time, I want each of you to tell me the probability of heads on this next toss.”

Dr. John replies in a calm, studied, and restrained tone, “The probability of the next toss being heads is 1/2 (0.5). This is because you originally told me that the coin is fair and each toss is independent of the rest. So, despite the previous 99 heads, the probability of the next toss being heads is unchanged from the beginning (i.e. 0.5).”

Fat Tony replies in a visible excited and somewhat agitated demeanor, “This is one big set up! The next toss HAS to be heads! I don’t trust you. You lied when you told us the initial rules.”

— –

And that is where the thought experiment stops.

Dr. John represents a certain (boring) view of the role randomness plays in his life. His academic qualifications and countless calculations of answers to questions like “probability of ____ from a randomly shuffled deck of cards”, have convinced him that randomness occurs within the bounds of well-defined rules, such as those described by Taleb in his thought experiment. Such people are often hired to design financial models for investment banks that then occasionally explode, causing an economy-wide meltdown like 2007. Meanwhile, individuals like Fat Tony distrust theory and prefer learning from their experience. Taleb terms these people “skeptical empiricists”, a group of thinkers he claims membership of. Fat Tony also recognizes the role of randomness in life, but in a different way. He instead calls into question the rules initially described by Taleb. Taleb asserts that in the real world randomness doesn’t occur how people like Dr. John are trained to think, but more like how people like Fat Tony are trained to think.

The Ludic Fallacy is more widespread than one may imagine. In an anecdotal experience, Taleb describes a time when he was hired by a Las Vegas casino to mitigate risk. Casinos are playgrounds of randomness and the big fear of many casinos is a gambler making a big bet and actually winning, colloquially referred to as “bringing the house down”. To protect against any such “unfair advantage” , casinos employ devices that would make a Bond villain jealous, including body heat sensors, eye ball trackers, and hiring people like Taleb as external ‘risk consultants’. But for that particular casino, the three biggest losses in its history occurred from:

- A loss of $100 million when an irreplaceable performer in their main show, titled Siegfried and Roy, was maimed by a tiger. This required the show to be cancelled, and thus all ticket fees were forfeited.

- A trained, experienced employee in charge of mailing a special form to the Internal Revenue Service inexplicably forgot to do so and hid them under his desk for many years. The forms documented whenever gamblers’ profit exceeded a specified amount. The IRS doesn’t take too kindly to tax violations (negligent or otherwise), and the casino ended up paying an (undisclosed) large amount to the IRS as a penalty.

- The casino owner’s daughter was kidnapped and this required him to dip into the casino’s coffers to extract the cash needed to ransom his daughter back.

The biggest losses in the casino’s history occurred outside the gambling floor. The above should convince you that the way people often think of randomness might not be the way it actually works in the real world.

But not all randomness is bad. Alas, randomness often gets a nefarious rep, something that is to be tamed using elaborate “risk management” strategies. Sometimes, the Ludic Fallacy misleads us into underestimating the positive role random chance plays in our life. For example, avid users of dating apps, may misconstrue (yours truly included), that randomness is whether a given paramour would match with you, or perhaps, whether she would reply to your opening message. However, that is simply the Ludic Fallacy in action.

The unconstrained nature of randomness in one’s life might be bumping into someone special in the elevator, or perhaps, running into a future business partner, while going for a walk in the park.

Simply put, the Ludic Fallacy unnecessarily exchanges the beautiful color that serendipity adds to our lives for the dull black-and-white, rules-based view of random chance.

If life truly is a game, and randomness is the dice which controls its outcomes, then we might as well smile and play along.